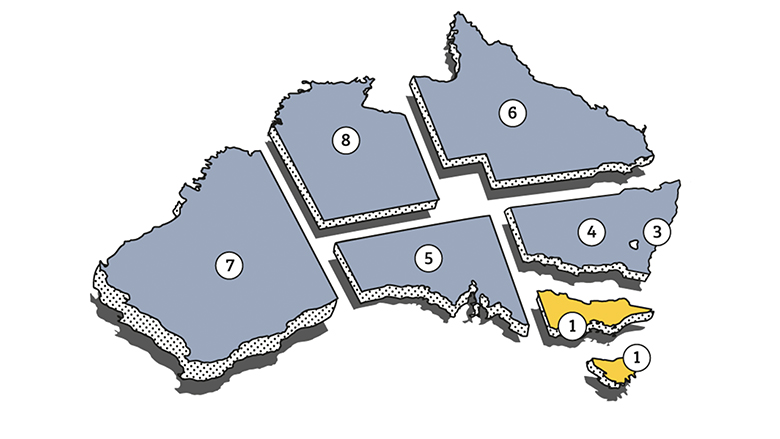

Victoria remains Australia’s strongest performing economy, but it now shares top spot with Tasmania, according to the latest CommSec State of the States report. Using the latest available information, the report provides a valuable snapshot of the nation in the lead up to the coronavirus crisis.

Now in its 11th year, the State of the States report has seen Victoria hold the top position for eight quarterly surveys, with its latest strong performance driven by economic growth, retail spending and construction work.

Tasmania’s economic performance ranking hasn’t been this strong since October 2009. The Apple Isle now shares top spot in the rankings, primarily due to above-‘normal’ growth in population (faster than the decade average) and subsequent strong demand for new homes.

The ACT has overtaken NSW into third position with its highest ranking in over a year, leading the way on relative unemployment, housing finance and equipment investment. NSW has slipped to fourth place, with South Australia and Queensland sitting in fifth and sixth position respectively. Western Australia remains in seventh position, ahead of Northern Territory.

CommSec Chief Economist Craig James said: “While we’ve seen movement at the top of the rankings, there is actually little separating the top four economies. Overall, some of the biggest improvements over the past quarter have come from South Australia, Western Australia and Northern Territory as these economies start to close the gap between those leading the rankings.”

The latest State of the States report uses the most up-to-date economic data, however it reflects conditions before the impact of the coronavirus had been felt by many Australian businesses and households.

“Regardless of the rankings, the impact of the coronavirus is posing significant challenges across all states and territories, especially those reliant on overseas tourism and overseas students. While each state and territory has its unique pressures, we really are all in this together.

“Future reports will prove valuable as we track how each state and territory is navigating through the crisis and into an eventual recovery phase. For example if we look ahead, recovery of the Chinese economy may boost prospects for resource economies like Western Australia, Northern Territory and Queensland. Also the relaxing of social distancing restrictions and bringing forward of infrastructure projects may serve to boost recovery prospects of state and territory economies more generally,” Mr James said.

State vs. State Annual Growth Rates

- When looking across growth rates for the states and territories, WA shares the top spot with Victoria and both states exceeded the national-average on six of the eight indicators from Tasmania and Northern Territory (four) and the ACT and Queensland (three).

- South Australia out-performed the national average on two indicators while NSW was ahead of the national average on just one indicator.

State and territory highlights

- Victoria remains in top spot for retail spending, relative economic growth and construction work. Retail spending in Victoria was 14.1 per cent above decade-average levels in the December quarter. Strong population growth, low unemployment, rising home prices and infrastructure building are key supports for retail spending.

- Tasmania retains the top spot for dwelling starts at 20.7 per cent above the decade-average. Tasmania is also strongest on the relative population measure, with its 1.00 per cent annual population growth rate 72.3 per cent above the decade-average rate.

- The ACT saw equipment investment at 10-year highs, up 37.9 per cent on the decade-average. The ACT also has the strongest job market when looking at unemployment rates across the state and territory economies. Not only is trend unemployment in the ACT at an equal 11-year low of 3.0 per cent, but this rate is 23 per cent below the decade average.

- NSW ranks second on relative economic growth with output 22.8 per cent above the ‘normal’ level of output (decade average). The state ranks third or fourth on most of the other economic indicators including construction (third place) and retail spending (fourth place).

- South Australia now ranks second strongest on relative population growth (up 2.5 per cent on the decade average), equipment investment (up 6.1 per cent on the decade average) and dwelling starts (up 7.8 percent on the 10-year average).

- Queensland is third ranked on relative population growth (up 1.8 per cent on the decade average). While the state remains fifth ranked on retail trade, spending is 9.6 per cent above the decade-average. Queensland also gained one spot on housing finance (up 19.0 per cent on the decade average).

- Western Australia ranked in third place for equipment investment (up 3.1 per cent on the decade average) and relative economic growth (up 21.9 per cent on the decade average). In fact, WA recorded the fastest nominal economic growth, up 12.9 per cent over the year to December, supported by stronger exports. When it comes to population growth, Western Australia saw an annual increase of 1.13 per cent, its fastest growth rate in 5 years.

- Northern Territory remains in eighth position, but encouragingly the Territory saw equipment investment near 4½-year highs, up 40.5 per cent over the year. The Northern Territory also improved one spot on relative economic growth and is now ranked sixth on this indicator (up 19.9 percent on the decade average).

To access the full State of the States Report for April 2020, including the detailed breakdown of each economic indicator and additional commentary from CommSec’s Chief Economist, Craig James, visit www.commsec.com.au/stateofthestates

Interviews with Craig can be requested via the CBA Media team on (02) 9118 6919 or [email protected].