Help & support

If you’re happy with switching to Principal and Interest repayments at the end of your Interest Only period, then you don’t need to do anything as this will happen automatically.

If you’d like to remain on an Interest Only or Interest in Advance period, get in touch to understand if further Interest Only options are available to you.

We may need to assess your financial circumstances to approve you for a new Interest Only period.

Call 1300 057 072 or contact your Lender, Relationship Manager, Private Banker or Broker.

A home loan repayment typically consists of two parts:

An Interest Only home loan is where you can choose your minimum repayments to only cover interest charges on your home loan for an agreed period of time.

This means that your loan balance does not reduce during an Interest Only period as you're not making any principal repayments.

Interest rates for Interest Only home loans tend to be higher than those for Principal and Interest home loans.

An Interest Only period is available for Investment home loans and Owner Occupied home loans.

Because you’re only paying the interest amount off your loan during your Interest Only period, you’re not paying the loan balance (principal component) which means you’re paying more interest over the life of your loan.

If you pay both the principal and interest you’ll reduce your loan balance earlier in the loan term, which means the amount of interest payable will also reduce, because interest is calculated on the outstanding balance of your home loan.

You can switch between Principal and Interest repayment and Interest Only payment options during the life of your loan, however there are limits on how long you can have Interest Only periods for.

These limits apply when you request a new or extended Interest Only payment.

As your interest only period is for a short time, eventually you'll need to pay off your loan balance. When your interest only period expires, your repayments will change to principal and interest. This means your repayments will increase and you’ll start to pay off your loan balance.

To prepare for this change and remain in control, know your expiry date and plan accordingly.

To find the expiry date, log on to NetBank > View accounts > Account Information. Make sure you select your Interest Only home loan from the list.

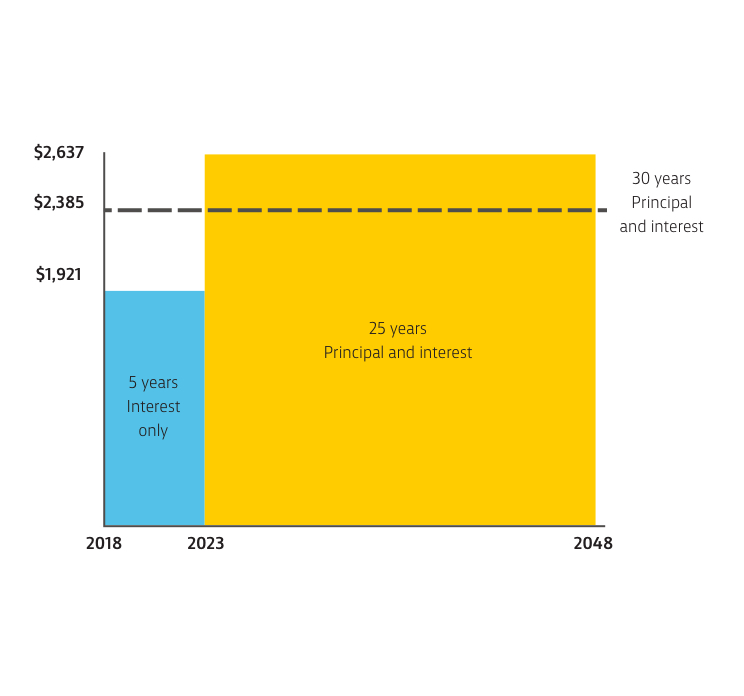

With an Interest Only loan you choose to make repayments that only cover the interest amount (for a short period). Interest Only payments are lower than if you were paying both the principal and interest components, however your loan balance isn’t reducing.

At the end of an Interest Only period, the balance of the loan must be paid back to the bank over the period remaining before the end of the loan. This means that the Principal and Interest repayment will be higher than it would have been prior to the Interest Only period.

In this example, Jo has taken out a home loan of $500,000 for 30 years.1

This means that over the life of her loan, Jo will pay an additional $47,867 interest – for the first 5 years of being on Interest Only.

Work out what your repayments might be using the repayment calculator.

Book instantly to speak to a Home Loan Specialist at a time that suits you.

Redraw, change your repayments or loan type to better meet your needs and more.

Fast-track your call, see expected wait times and connect with a specialist in the CommBank app.

Get instant help from our virtual assistant or chat to a specialist.

1 Calculations are estimates provided as a guide only. They assume interest rates don’t change over the life of the loan and are calculated on the rate that applies for the initial period of the loan. Interest rates referenced are current rates and may change at any time. Fees and charges are payable. The calculations do not take into account fees, charges or other amounts that may be charged to your loan (such as establishment or monthly service fees or stamp duty).

2 Everyday Offset is a feature of our Complete Access Transaction Account which is linked to an eligible home loan, and accountholder/s must also be accountholders of the linked home loan. Interest is not charged on that part of the Home Loan balance equal to the balance of the Complete Access account.

Applications are subject to credit approval. Full terms and conditions will be included in our loan offer. Fees and charges are payable. Interest rates are subject to change.

As this advice has been prepared without considering your objectives, financial situation or needs, you should consider its appropriateness to your circumstances before acting on this advice.