With online shopping now part of our daily lives - from your weekly food shop to the things you simply want to buy - it’s easy to make purchases online with StepPay.

Been browsing up a storm?

Whether you’re looking to buy a quality frypan to up your dinner game, you’ve run out of lockdown board games or your mattress needs replacing, when shopping online with StepPay the hardest part is doing the research and deciding what you want.

Once chosen it’s easy to pay for it online and we’ll automatically split your purchases of $100 or more into four equal, fortnightly repayments. For purchases under $100, the full amount will come out of your linked CommBank account in one go, two days after the transaction is posted to your StepPay account.

How StepPay’s buy now, pay later works at the online checkout

Once you’ve settled on your online purchase, paying for it isn’t all that different from what you’re used to when paying with a debit or credit card. When you get to the online checkout - where you would usually select the card you want to use - you simply enter the details of your virtual StepPay card. It’s simple to access your virtual card in a few simple steps:

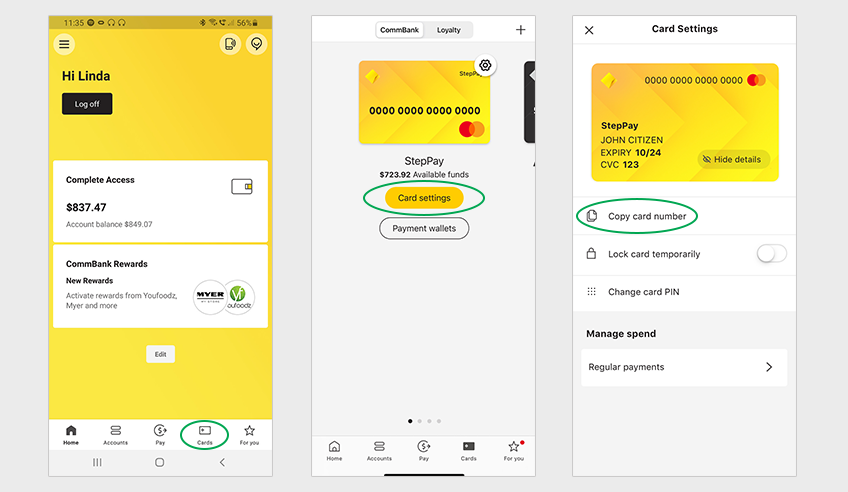

Step one: Jump into your CommBank app and tap Cards at the bottom

Step two: Swipe to find StepPay and press on the card or ‘Card settings’

Step three: Now you can see the card number and the hidden expiry and CVC, simply press ‘Show details’ or ‘copy card number’

Step four: At checkout, enter these details manually or simply paste and hit purchase

Once your payment is processed, leave StepPay to automatically deduct the repayments from your linked CommBank account. Nothing for you to do here, all the work has already been done when you set up StepPay in the first place.

StepPay is equally easy in-store

If you’re shopping in a physical store, it’s just as easy to pay with StepPay. Maybe even easier.

At the register, StepPay works the same as all the digital cards in your digital wallet. You just go into your wallet, select your StepPay card and enter your pin or let facial recognition works its magic. Then you just tap it.

Note that you can set up StepPay as your primary card of choice which means it comes up by default when you open your digital wallet, making it even faster at checkout time.

A buy now, pay later product with a completely digital card, you won’t have to wait for a “card” to be delivered or a letter explaining how to activate it before you can spend. With StepPay, your card can be added to your digital wallet in minutes and you’re free to purchase that cookware.

And you have the security and convenience of having StepPay there in your digital wallet.

More about StepPay

Learn more about StepPay, a way to buy now, pay later wherever, on whatever