Credit card interest is a charge for borrowing money from a financial institution with your credit card. How much interest you’ll pay depends on the type of card you have, the transactions you make, and when you make repayments.

Calculating credit card interest

How your credit card interest is calculated may vary depending on who you bank with. At CommBank, we calculate interest from the day each purchase is made up until it's repaid in full. This applies to all purchases unless you're eligible for an interest-free period. (We explain interest-free periods below.)

We calculate interest at the end of each statement period by averaging the amount you borrowed each day and using the rates set out in your contract.

To work out your interest charges, we calculate interest separately for:

- Purchases

- Cash advances

- Balance transfers

- SurePay® instalment plans

For each of these categories, we follow these steps:

- Average the balances over the statement period

- Multiply the average balance by the applicable daily interest rate (annual rate divided by 365)

- Multiply the above amount by the number of days in the statement period

If you have a balance transfer or instalment plan, the interest rate we use will be shown when you apply. Applicable interest charges and interest rates can also be found on your monthly credit card statement.

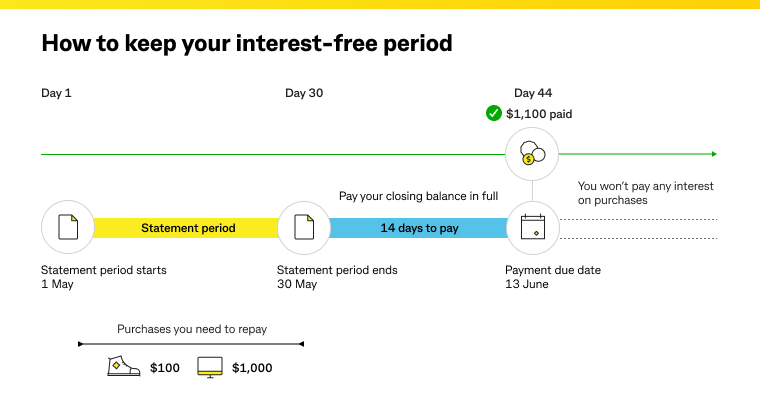

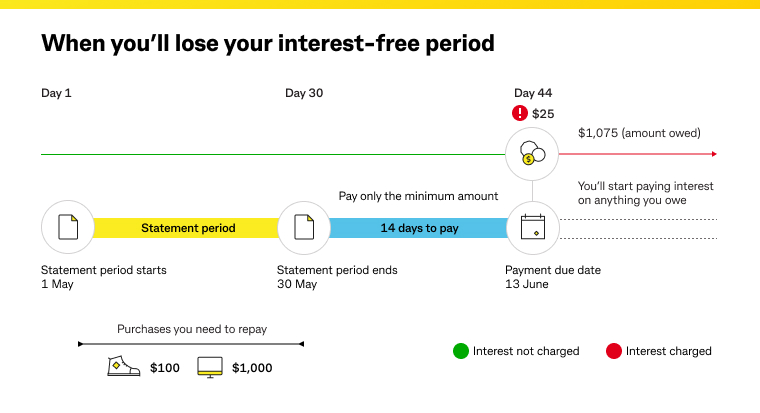

Interest-free periods on purchases

Most CommBank credit cards come with an interest-free period on purchases of up to 44 or up to 55 days, meaning you won’t be charged any interest on purchases, so long as you pay your closing balance in full by the due date every month.