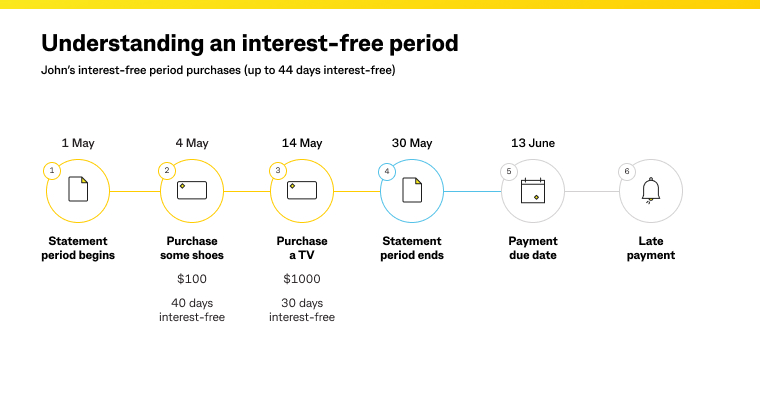

In the above example, John’s interest-free* period on purchases is up to 44 days.

1. 4 days after John’s statement period begun on May 1, John purchases some shoes for $100. He has 40 days interest-free on this purchase.

2. On May 14, John purchases a TV for $1,000. He has 30 days interest-free on this purchase.

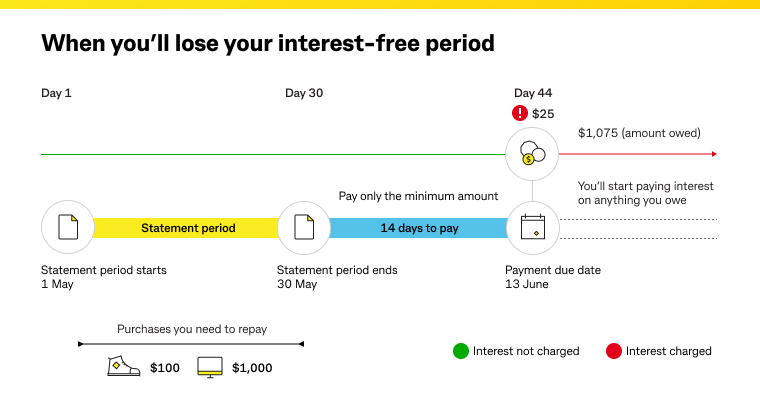

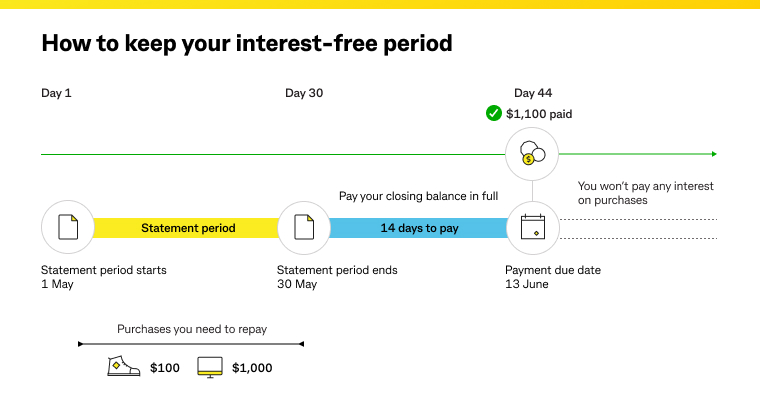

3. On May 30, John’s statement period ends and he receives his statement. John now has 14 days to pay off his closing balance in full which is made up of his purchases during the period. In this case, his closing balance is $1,100.

4. June 13 is John’s payment due date. To avoid paying any interest on the purchases he’s made, John must pay his closing balance in full by the payment due date. If he doesn’t pay in full, he’ll lose his interest-free period on purchases and interest will be charged on his unpaid balance (including any purchases made since his last statement period ended) from after the payment due date.

John will receive a late payment fee if he doesn’t pay at least the minimum payment shown on his statement by the due date each month.