Help & support

No annual fee.

Manage online with CommBiz or NetBank – request online statements, establish automated payments, order cards and change daily withdrawal limits.

Stay in control with alerts and payment reminders.1

Transactions updated instantly – so you’ll always know where you stand.2

Separate your business expenses from your personal, making your business activity statement (BAS) easier.

Included Transit Accident Insurance and Unauthorised Transaction Insurance.3

Instantly lock international payments, block ATM cash withdrawals and limit your spending from the CommBank app or NetBank.4

24/7 emergency assistance overseas if you lose your card.

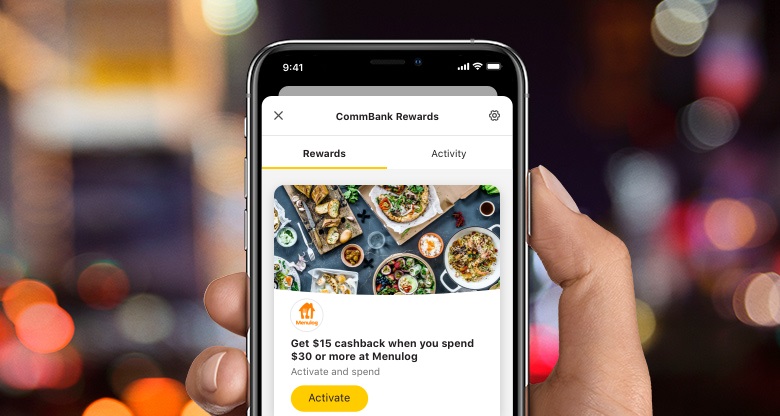

Cashback benefits for eligible cardholders through CommBank Rewards5 in the CommBank app.

Simple application process.

Minimum credit limit of $500.

Unsecured credit limit of up to $50,000 (based on eligibility criteria).

Access to a unique collection of experiences and offers exclusively for Mastercard® cardholders through Priceless Sydney and Mastercard Privileges.

CommBank is rewarding you when you shop, which is why we’ve partnered with big brands to give you cashback when you activate and redeem your CommBank Rewards.

We'll send you shopping rewards based on where you've shopped before, and similar places we think you'll like.

Available to eligible5 Mastercard® cardholders in the CommBank app.

Other fees may apply. For full details, see the Personal Liability Business Credit Cards Standard Fees and Charges (PDF)

CommBank Yello customers can receive up to 10% of the booking amount back in travel credits to use towards any future purchases in Travel Booking.#

1 Subscription to this service may be limited.

2 Excludes some manual transactions and some contactless payments.

3 View our Certificate of Transit Accident Insurance (PDF) and Certificate of Unauthorised Transactions Insurance (PDF).

4 Lock, Block, Limit does not apply to transactions that are flagged as recurring (e.g. direct debits) and transactions not sent to us for authorisation. Except for the spending cap, transactions made via Tap & Pay set up on a compatible smartphone or via a PayTag are not blocked. Some transactions made via CommBank branches, telephone, online or mobile banking, including transfers to other accounts, bill payments, and assisted cash withdrawals are also excluded. Other conditions apply.

5 The CommBank Rewards program ('CommBank Rewards') rewards you with cashback after you activate (where required) an offer presented to you via the CommBank app and you make a purchase in accordance with the Terms and Conditions of that offer. Cashback is typically received within 14 business days of a qualifying purchase, but in some cases may take longer. If you are not already enrolled, you can enrol if you are at least 18 years old, hold an eligible CommBank credit Mastercard or debit Mastercard, Business credit Mastercard or StepPay digital card, and are an Australian resident living in Australia. CommBank travel money cards, corporate credit cards, business debit cards and pre-paid Mastercards are not eligible. Your participation in CommBank Rewards is governed by the full Terms and Conditions available in the CommBank app.

6 Charge applies to cash advances through a terminal of any financial institution in Australia, at ASB Bank in New Zealand and Commonwealth Bank in Indonesia.

7 A maximum charge of $150.00 (or a flat fee of $2.50 applies if your closing balance on previous business day was in credit).

8 Charge applies to cash advances at Commonwealth Bank branches.

9 Fee applies to cash advance transactions made at other financial institutions within Australia.

10 Charge applies to cash advances by way of funds transfer through NetBank, PhoneBank Transfer, Commonwealth Bank Customer Service Centre, Australia Post, 13 2221 Transfer Cash, NetBank Transfer Home Loan, Mobile Bank Transfer and NetBank Transfer Personal Loan.

11 Charge applies to purchases of cash equivalent items or cash substitutes including gambling transactions or traveller’s cheques.

Note: For cash advances and balance enquiries made through a non-Commonwealth Bank ATM in Australia, the ATM owner may charge you a fee, which will be disclosed at the time of the transaction. If you proceed with the transaction, the ATM owner’s fee will be debited to your account (in addition to the cash advance amount) if applicable. You should check the ATM owner’s fees that apply carefully before completing.

Applications for finance are subject to the Bank’s normal credit approval. Full terms and conditions are included in our Letter of Offer. Bank fees and charges may apply. This advice has been prepared without considering your objectives, financial situation or needs. Before acting on the advice, please consider its appropriateness to your circumstances. You can also download our Financial Services Guide (FSG) (PDF).

You can add your CommBank business credit cards and Visa Business Debit card to Apple Pay. Some CommBank cards are ineligible for Apple Pay including Mastercard Business Debit Card and Corporate card.

Apple, the Apple logo, Apple Pay, Apple Watch, MacBook Pro, iPad and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries.

Mastercard® is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Commonwealth Bank of Australia ABN 48 123 123 124 Australian credit licence 234945.

View Terms and Conditions for Electronic Banking (PDF), NetBank and CommBiz (PDF) and consider them before making any decision about these products.

The CommBank Business Credit Cards are Personal Liability Business Credit Cards. By applying, you (the individual that is applying for a Business Credit Card) acknowledge that the Business Credit Card you are applying for provides for Personal Liability. We will look to you (and no any company, partnership or other business entity that may employ or engage you) to recover all amounts charged using the Business Credit Card, including any amounts charged by an additional cardholder.

Travel booking, provided by Hopper

# CommBank Yello Plus customers receive 5% back in travel credits. This applies to the hotel booking amount you pay for excluding any Awards points or travel credits redeemed.

CommBank Yello Gold customers receive 5% back in travel credits. This applies to the hotel or flight booking amount you pay for excluding any Awards points or travel credits redeemed.

CommBank Yello Diamond customers receive 10% back in travel credits. This applies to the hotel or flight booking amount you pay for excluding any Awards points or travel credits redeemed. You’ll also receive a $100 first time use travel credit which will be automatically applied to your Travel Booking wallet on your first visit to the Travel Booking website after entering Diamond status. This is limited to one per customer, regardless of movement between tiers.

For more information about the CommBank Yello program, visit commbank.com.au/commbankyello

Travel credits will be applied to your Travel Booking Wallet within 7 business days of your booking and have a 2-year expiry from the booking transaction date. If you cancel or the supplier cancels the flight or hotel booking for any reason, the amount back in travel credits will be forfeited. Travel credits are not transferable or exchangeable for cash. Expiry dates can be viewed in your Wallet & Offers page of the Travel Booking website.

When redeeming travel credits, the entire value of your travel credit wallet will be applied to pay for all or a portion of the booking amount in a single transaction. If the booking amount is less than the total value of your travel credits, the remaining balance will remain in your wallet for future use.

In the event that you no longer hold an active eligible CommBank card, you will forfeit all your travel credits.

All travel products and offers from Travel Booking are subject to availability and can only be booked by eligible CommBank cardholders.

Eligible cards comprise of active CommBank retail or business credit and debit cards, StepPay card or Travel Money Cards.

Travel Booking is provided by Hopper Inc (Hopper). Hopper is not part of the CBA Group. CBA is not responsible for the content on this portal, nor the provision of any of the services that are offered through this portal. The services offered are subject to the Travel Booking terms and conditions. CBA does not guarantee the obligations or performance of Hopper or the services it offers. CommBank Awards customers can choose to use all or part or all of their Awards points for payment of their booking.

CommBank will receive a portion of the revenue generated from the Travel Booking platform.

For full terms and conditions on the features provided by Hopper, visit travelbooking.hopper.com/terms

Commonwealth Bank of Australia ABN 48 123 123 124 AFSL and Australian credit license 234945