Award winning online broker

With over 25 years of industry leading experience, CommSec offers Australia's best online and mobile trading solutions.

Choose how your money is invested, track your balance and more with a CommSec Australian Shares account.

When you buy a share, you own part of a company. Your investment grows as the company’s value increases or when it pays dividends (a portion of profits distributed to shareholders). Reinvesting dividends and holding shares longer term can allow your money to grow through compounding.

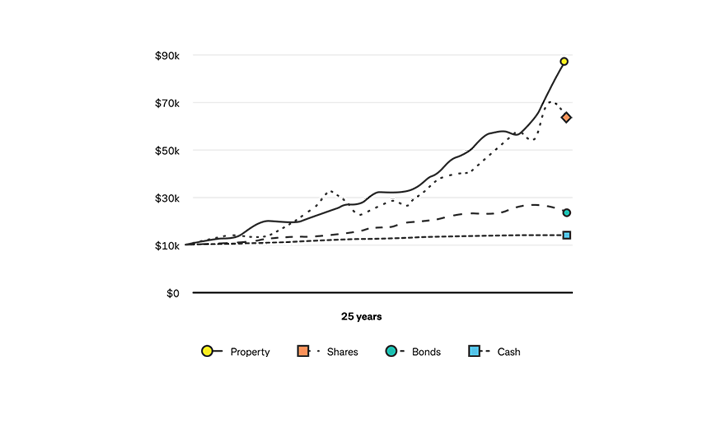

Over the past 25 years, shares have delivered better than average returns compared with other investments.1 They also offer flexibility, as you can usually access your money within two business days of selling.

It’s important to note that shares come with risks such as capital loss risk (Investment value can decrease), liquidity risk (buying or selling can be difficult due to market conditions) and market and economic risks (share price can be impacted by several factors). To manage risk, consider an investment option which suits your needs and circumstance. Of course, when considering investing for the first time you should always seek your own financial advice.

Trade from just $5, with no monthly fees or ongoing account charges.^

^ To be eligible, you must trade online, be CHESS Participant Sponsored with CommSec and settle your trades through either a Commonwealth Direct Investment Account (CDIA) or a CommSec Margin Loan.

Current offers for our eligible customers

Get started with $0 brokerage

New to CommSec customers can enjoy $0 brokerage on up to 30 trades*

Limited time offer.

CommBank Yello investing benefit

Receive up to $10 monthly loyalty benefit as an eligible CommBank Yello customer for investing**

With over 25 years of industry leading experience, CommSec offers Australia's best online and mobile trading solutions.

You will need to have the following handy:

Opening a CommSec account is free and there are no ongoing account-keeping fees. A brokerage fee does apply per trade and is tiered by trade value.

Trade amount |

Cost* |

Up to $1,000 (inclusive) |

$5 |

Over $1,000 up to $3,000 (inclusive) |

$10 |

Over $3,000 up to $10,000 (inclusive) |

$19.95 |

Over $10,000 up to $25,000 (inclusive) |

$29.95 |

Over $25,000 |

0.12% |

You can apply for a CommSec Share Trading Account if you are:

A settlement account is a linked bank account used to manage the money going in and out of your trading account. When you buy or sell shares, a process called T+2 settlement takes place where ownership of the shares are exchanged for money between the buyer and seller. This occurs on the second business day after the trade takes place. By opening a CommSec Australian Shares account via the CommBank app, you'll also open a Commonwealth Direct Investment Account (CDIA), providing you with our best brokerage rates and real-time fund transfers.

Important: The shares you wish to transfer (whether held with another broker or the share registry) must have identical registration details (both name and address) to your CommSec trading account. If registration details differ by even one character, you will need to change these details before completing the form.

You can transfer shares held with another broker (i.e., Stake, nabtrade), with the share registry (i.e., Computershare, MUFG Corporate Markets), or in another CommSec account, by logging into CommSec.

To transfer shares into CommSec, log into CommSec, head to Settings, navigate to Service Request, then select Transfer Shares. Once you begin the transfer, you’ll be asked a series of questions about your shares.

For the transfer to be successful the name and address registered on your holdings must match your CommSec account.

This process normally takes 2-3 business days to complete.

You can use both the CommBank app and the CommSec app to trade and manage your CommSec Australian Shares account. To view your shares in the CommBank app simply log in, tap the ‘Investing hub’ tile from your app dashboard or Library.

When considering investing in shares there are a few questions to ask:

Analysts use key measures like the price to earnings ratio, price to book ratio, earnings per share and dividend yield, as well as overall share price performance of a particular share to understand its overall value. Of course, if investing for the first time you should seek out your own professional financial advice first to understand your risk profile. Also note that past performance is not a reliable indicator of future performance when doing your stock selection.

Check out the Market highlights,the CommSec Invest podcast, and explore the ‘Learn’ tab via the Investing hub in the CommBank app.

Compounding is when your investments earn returns, and then those returns start earning returns too. Over time, this can help your money grow faster.

For illustrative purposes only: if you invested $1000 and earnt a 5% return, you’ll have $1050 after a year. If you leave that money invested, the next year if you earn another 5% on your original $1,000 and on the $50 you earned – so your total grows to $1,102.50. The longer you stay invested, the bigger the effect of compounding. Reinvesting dividends can also help your money grow over time. Learn more about how compounding can benefit your strategy.

How to calculate the potential return on investment?

Return on Investment (ROI) is the gain/loss you have made on your initial investment.

ROI =

Example:

Purchase price = $5.00

Sale price = $6.00

No of shares purchased = 100

Brokerage fees = $10 ($5 to buy and $5 to sell)

(Sale Price – Purchase Price) x Number of Shares Purchased – Brokerage fees = ($6.00 - $5.00) x 100 - $10 = $90

This is your profit.

Purchase Price x Number of Shares Purchased + Brokerage fees = $5.00 x 100 + $10 = $510

This is your initial investment.

Return on Investment (ROI) = $90 ÷ $510 x 100 = 17.64%

Was the information on this page useful?

Investors should consult a range of resources, and if necessary, seek professional advice, before making investment decisions in regard to their objectives, financial and taxation situations and needs because these have not been taken into account. Any securities or prices used in the examples given are for illustrative purposes only and should not be considered as a recommendation to buy, sell or hold. You can view the CommSec Share Trading Terms and Conditions our Financial Services Guide and should consider them before making any decision about these products and services. Past performance is not indicative of future performance.

*$0 brokerage on your first 30 trades offer is available exclusively for eligible new to CommSec customers.

To be eligible, new customers must:

The offer will be applied to your new trading account from 1 December 2025 if you have met the above eligibility criteria by 31 December 2025.

As part of the offer, you will receive $0 brokerage on up to 30 trades with a maximum trade value of $50,000 each for orders placed between 2 January 2026 and 30 June 2026. Trades must be placed online via the CommSec website or app platforms and be CHESS-sponsored by CommSec.

Trades above $50,000 will incur standard brokerage charges. Taxes and fees including FX will apply to International trades. Standard CommSec brokerage charges apply for orders placed or amended outside the period 2 January 2026 to 30 June 2026. For CommSec standard brokerage charges, view the CommSec Financial Service Guide. No brokerage fee will be shown on the CommSec trade confirmations issued for applicable trades under this offer. For eligible International accounts, the offer will be applied to the account type selected at the time of application (International Standard or International Plus). Changes to the International account type during the campaign period will result in loss of the offer. This offer is not redeemable for cash and is not transferable.

The offer is not valid in conjunction with any other offer and not open to existing CommSec customers. This offer does not apply to CommSec Pocket trades. You are not eligible for this offer if you have closed a pre-existing trading account (either Australian Shares, International Shares or Exchange Traded Options) on or after 1 December 2025.

Applicants must be 18 years or over. We reserve the right to terminate this offer or amend these terms and conditions at any time without notice. For any queries on this offer, please contact us on 13 15 19.

** “Monthly loyalty payment” benefit (CommBank Yello CommSec Benefit) only available to CommBank customers eligible for the Gold and Diamond Benefit Sets in the CommBank Yello customer recognition program. You may qualify for the CommBank Yello CommSec Benefit and thereby receive a monthly loyalty payment if you are eligible for the CommBank Yello Gold and Diamond Benefit Sets, trade with an Individual Australian Share Trading Account (excluding joint accounts, company accounts and trustee accounts) and settle at least 1 trade greater than $1,000 monthly into a Commonwealth Direct Investment Account (CDIA).

Additionally, to obtain the CommBank Yello CommSec Benefit, trades subject to eligibility assessment must relate to online trades that are CHESS-sponsored by CommSec. The CommBank Yello CommSec Benefit does not apply to CommSec Pocket trades, International Share Trades, Exchange Traded Options, or trades financed by Margin Loans.

Fulfilment for the CommBank Yello CommSec Benefit occurs monthly, and your eligibility is typically assessed in the first week of each month for your trades settled in the previous calendar month. No payment will be paid if you do not retain status as a CommBank Yello Gold or Diamond customer when eligibility is assessed (that is, you no longer remain eligible for the CommBank Yello Gold and Diamond Benefit Sets).

You should consider the tax implications of receiving the CommBank Yello CommSec Benefit. You should check with your accountant or tax adviser if you are not sure about the tax implications to you of the payment. Details of the payment are available in your CommSec EOFY Statement.

Full information on CommBank Yello and eligibility conditions are available in the CommBank Yello Terms and Conditions and CommBank Yello FAQs.

The CommBank Yello CommSec Benefit is not transferable. Eligible customers must be 18 years or over. CommSec may terminate or withdraw the CommBank Yello CommSec Benefit and may, acting reasonably, amend the terms and conditions applying to the CommBank Yello CommSec Benefit at any time. In both cases, CommSec will provide notice prior to doing so or as soon as is practicable after doing so. Termination or withdrawal of the CommBank Yello CommSec Benefit and any change to its terms and conditions will apply prospectively and will not impact any benefit already received or accrued. If you are not happy with any change to the terms and conditions, you may opt out of CommBank Yello by messaging in the CommBank app or visiting a branch. By receiving the CommBank Yello CommSec Benefit, you are taken to agree to these terms and conditions.

1 Sourced from Reuters, Real Estate Institute of Australia, CoreLogic and IRESS. Data from: 1996-2022 – to June 30.

2 To be eligible, you must trade online, be CHESS Sponsored with CommSec and settle your trades through either a Commonwealth Direct Investment Account (CDIA) or CommSec Margin Loan.

The information has been prepared without taking into account your objectives, financial situation or needs. For this reason, any individual should, before acting on this information, consider the appropriateness of the information, having regards to their objectives, financial situation or needs, and, if necessary, seek appropriate professional advice. You can view the relevant CommSec Share Trading, International, Exchange Trade Options (ETO) and Margin Loan disclosure documents here and the CDIA disclosure document here and should consider them before making any decision about these products. Investing in overseas markets exposes you to risks including those related to movements in foreign currency exchange rates and market prices. CDIA and ETO TMDs can be located on the CommBank website and CommSec website, respectively.

Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (CommSec) is a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123

124 AFSL 234945. CommSec is a Market Participant of ASX Limited and Cboe Australia Pty Limited, a Clearing Participant of ASX Clear Pty Limited and a Settlement Participant of ASX Settlement Pty Limited. The Commonwealth Direct Investment Account (CDIA) and CommSec Margin Loans are issued by Commonwealth Bank of Australia. These products are administered by CommSec.

© Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (CommSec) is a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945. CommSec is a Market Participant of ASX Limited and Cboe Australia Pty Limited (formerly CHI-X Australia Pty Limited), a Clearing Participant of ASX Clear Pty Limited and a Settlement Participant of ASX Settlement Pty Limited. Commonwealth Direct Investment Account is a product of the Bank and is marketed by CommSec. As this information has been prepared without taking into account your objectives, financial situation or needs you should, before acting on this information, consider its appropriateness for your circumstances. Please consider the full terms and conditions which are available on request. Fees and charges apply.

The CommBank app is free to download, however your mobile network provider charges you for accessing data on your phone. Find out about the minimum operating system requirements on the CommBank app page. Terms and conditions are available on the app. NetBank access with NetCode SMS is required