Help & support

Your home loan statements are provided twice a year, in January and July. If there are specific changes to your loan, such as an interest rate change, or if you switch your loan type or increase repayments, you’ll receive a confirmation of the change within your ‘Transactions’ listing and the date it happened.

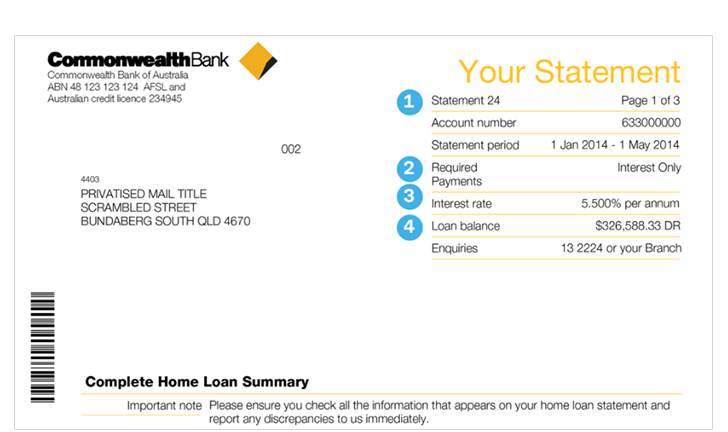

1. Statement number: The number of statements issued to you from your home loan start date.

2. Required payment/repayment amount: The minimum amount you have to pay to ensure your loan is paid off within the agreed term. If you've chosen to make Interest Only payments (as in the case of this example), then 'Interest Only' will be shown here.

3. Interest rate: This shows your current interest rate. If there were any changes during the statement period, they will be shown on the ‘Transaction’ page.

4. Loan balance: This is the balance owing on your loan at the statement’s end’ date. Please note this is not a 'payout' figure.

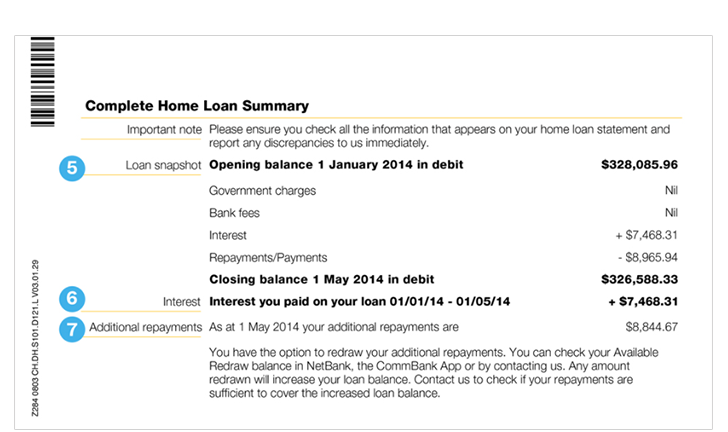

5. Loan snapshot: A summary of the total debt and credit transactions processed during the statement period.

6. Interest: Shows the total interest charge since the previous statement period.

7. Additional repayments: This shows the amount you’re ahead on your loan, which increases as you make additional repayments. This includes repayments made on your home loan over and above the minimum repayment. If you have an eligible home loan, you have the option to redraw your additional repayments. You can check your available redraw balance in NetBank, the CommBank App or by contacting us.

8. Repayment changes (not shown in diagram): If your minimum required repayments are changing, you’ll see a message in the transaction history of your statement informing you of the changes. If your repayments need to increase, you’ll also receive a notice depending on your mailing preferences, informing you of the changes and explaining what you need to do.

9. Interest rate changes (not shown in diagram):

Did you know you can receive statements in NetBank? To go green and turn off paper:

If you’re not registered for NetBank and would like to view your statements online, register for NetBank now.

Book instantly to speak to a Home Loan Specialist about a new loan at a time that suits you.

Redraw, change your repayments or loan type to better meet your needs and more.

Fast-track your call, see expected wait times and connect with a specialist in the CommBank app.

Get instant help from our virtual assistant or chat to a specialist.