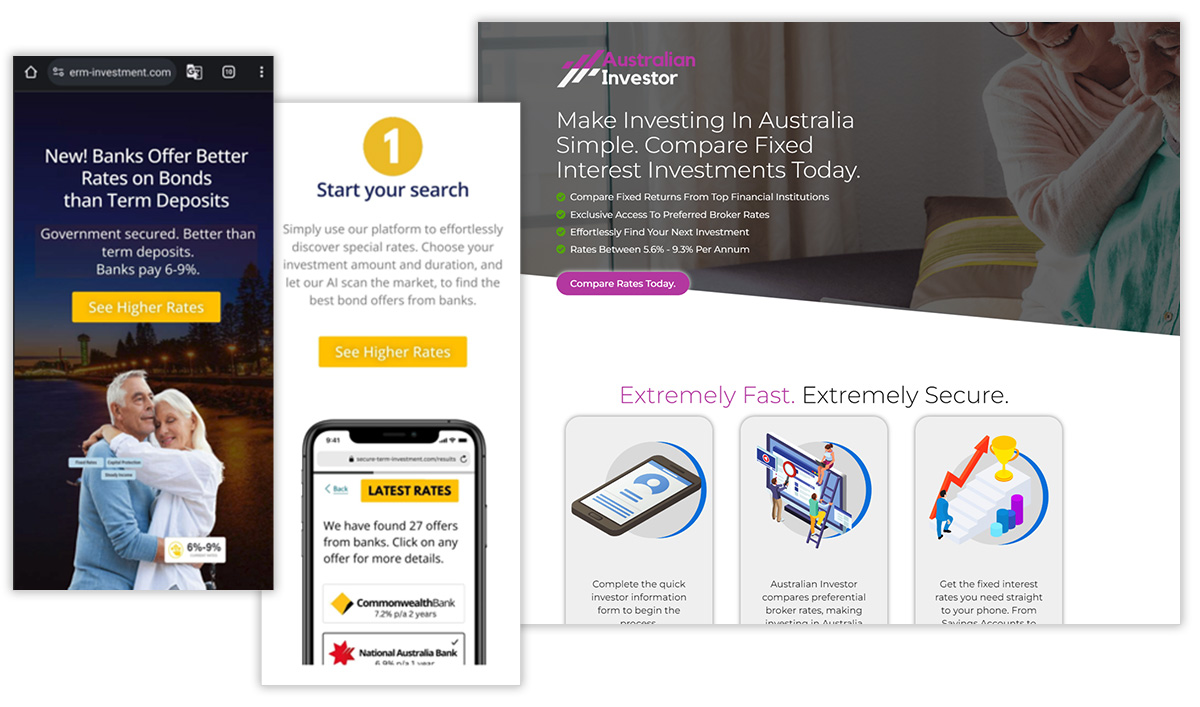

Scam alert:

Fake Term Deposit and bond scams

There has been an increase in investment scams posing as legitimate Term Deposit or bond offerings. Those being targeted will be asked to fill in a form via a 'contact us' page' from which scammers will then initiate contact. They will appear knowledgeable/sophisticated and insist on funds being transferred into a fake investment account.

Always treat unsolicited contact about investment opportunities as suspicious and remember to Stop, Check and Reject if you’re unsure.