Help & support

Dealing with financial shock

Making a big financial decision

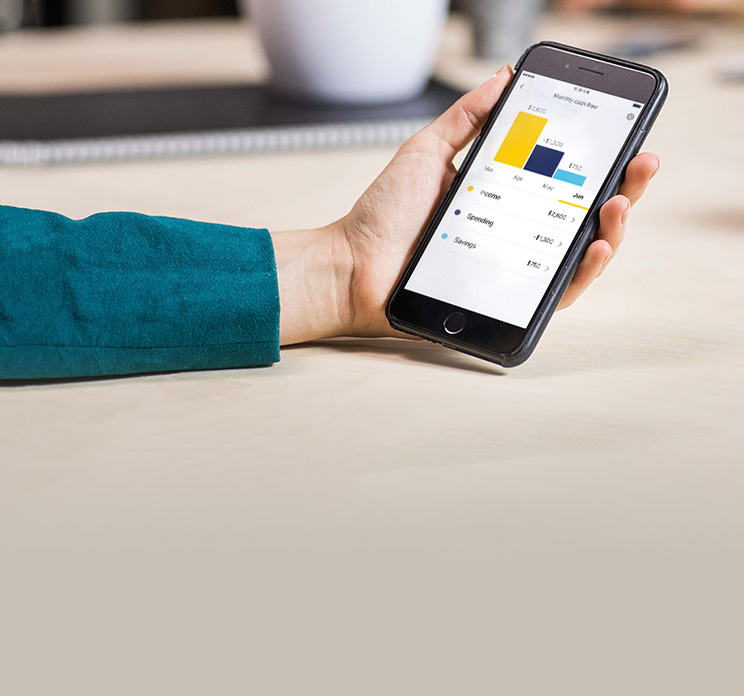

Whether you’d like to save for a holiday or a new laptop, or build a rainy day fund, there are plenty of tools and small spending changes that can help make saving easier.

We've partnered with the experts at UTS to bring together tips and tricks on how to make your savings journey a breeze. Learn more by watching our savings guide.

Whether you’d like to save for a holiday or a new laptop, or build a rainy day fund, there are plenty of tools and small spending changes that can help make saving easier.

We've partnered with the experts at UTS to bring together tips and tricks on how to make your savings journey a breeze. Learn more by watching our savings guide.

Work out where your money is going and set yourself guidelines for spending moving forward.

1 Requires a GoalSaver or NetBank Saver in your name only.

Our articles are intended to provide general information of an educational nature only. They do not have regard to the financial situation or needs of any reader and must not be relied upon as financial product advice.