This year, Scams Awareness Week will run from 27 November to 1 December, with impersonation scams being the theme.

Help & support

This year, Scams Awareness Week will run from 27 November to 1 December, with impersonation scams being the theme.

Scamwatch reports that approximately 80% of scams reported involve some form of impersonation.1

Scammers can impersonate financial institutions, telecommunication services, toll services, postal delivery services, and companies looking to recruit employees.

They can even pose as your family, friends, staff, or colleagues. Through impersonation, scammers can use different scam types, using a variety of channels, to trick people into providing sensitive or personal details, access to accounts, and transferring funds.

At CommBank, we’re supporting the ACCC, SAN and NASC to educate Australians on impersonation scams and how to protect yourself and/or your business during Scams Awareness Week 2023 and beyond.

Scams come in different forms, like phishing scams and more targeted impersonation scams.

While phishing scams can be quite common and often get picked up by your email provider’s spam filter, impersonation scams tend to be more targeted and sophisticated – impersonating someone you may know personally and asking you to share your personal information and/or transfer money.

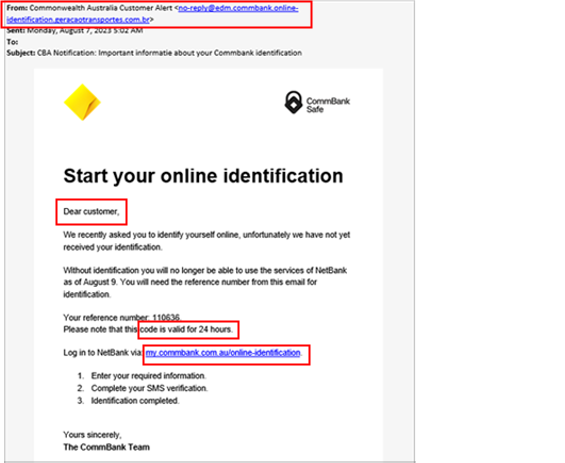

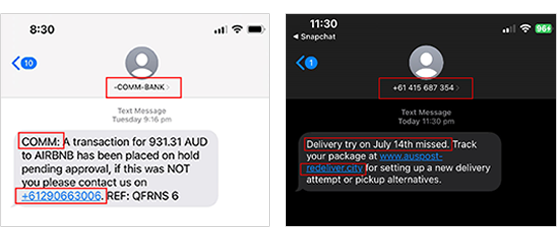

Here are some examples of phishing and impersonation scams:

Phishing scam emails, like the one above, often:

You can find out how to protect yourself from phishing scams in the video below:

Impersonation scam messages, like the examples below, often:

You can find more information on scams and different types of scams on our How to protect yourself from scams and Scams that target businesses pages.

Keep up-to-date with the latest scams.

If you’re a business customer, you can also visit our online Business scam and cyber security hub for resources and tools to help keep your business safe.

View our range of webinars on helping you stay safe online.

Listen to Season 2 of the Anatomy of a Scam podcast.

Message us immediately if you're worried about the security of your account. Our virtual assistant Ceba can help you lock your card or securely connect you to a specialist.

To report a suspicious email, message or call claiming to be from us at CommBank, you can forward the details to hoax@cba.com.au. You can also report a scam to Scamwatch.

1 Source: Scamwatch

* ACCC. (2023). Targeting scams: Report of the ACCC on scams activity 2022.