Help & support

We all experience it. One minute you’re feeling flush with cash, the next you’re wondering where your money goes.

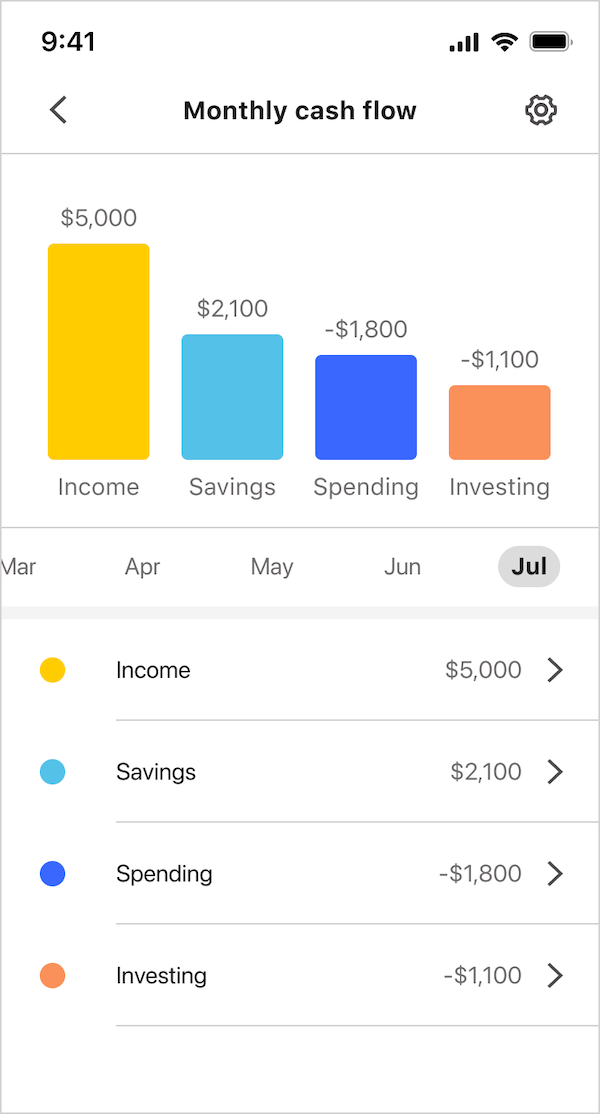

Cash Flow View breaks down your money into income, spending, savings and investments categories month-by-month, so you can see how you’re trending.

It will help you see where you’re on track and where your finances are taking a hit – giving you more financial awareness and helping you stay in control.

See a daily snapshot of your business’ cash flow.

Tap on Cash Flow View in the app to get a snapshot of where your money’s going each month.

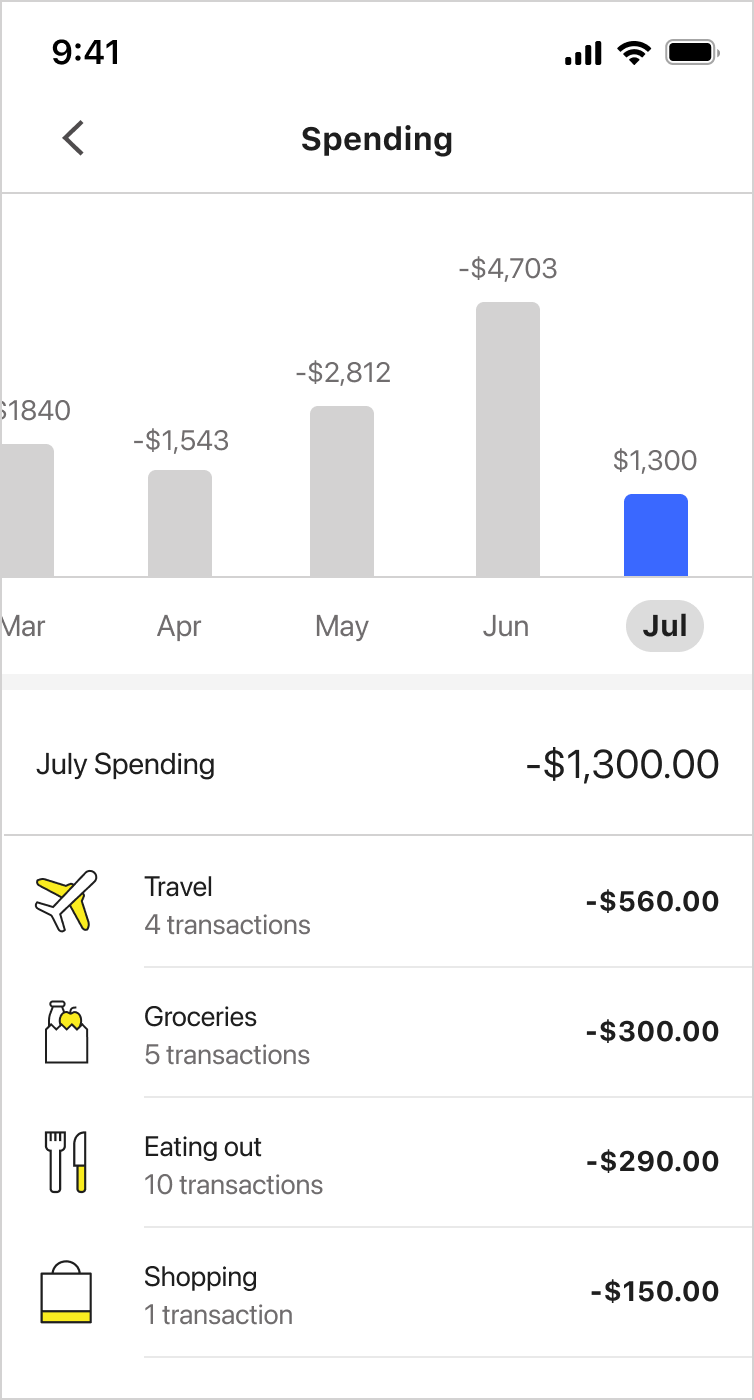

Tap ‘Income’, ‘Spending’, ‘Savings’ or ‘Investing’ to see a more detailed month-by-month breakdown.

Cash Flow View shows your overall spending habits and how they’re changing over time. Use it with Spend Tracker (to see what you’re spending on) and Category budgets (to set budgets for your spending) so you can make better decisions about your finances.

Knowing exactly what you’re spending, and if you’re overspending, helps you work out how much you can comfortably save.

Add a savings goal with Goal Tracker1 in Cash Flow View and we’ll break it down into weekly targets so it’s easier to reach. We’ll also help you set up automatic payments to your goal so you never miss your weekly targets, with nudges when you need them most.

You can also use Smart Savings to help create regular savings habits. Smart Savings looks at your income, bills, spending and transfers to predict and identify spare cash available each pay cycle.

Cash Flow View shows single and joint account info from the following accounts: Goal Saver, NetBank Saver, Complete Access, Smart Access, Everyday Offset, Streamline Basic, and all personal Low Rate, Low Fee and Awards credit cards.

1 Goal Tracker requires a GoalSaver or NetBank Saver account in your name only.

Smart Savings is available in CommBank app versions 4.38 or above. Terms and conditions as well as important disclosures apply to Smart Savings and will be provided during the set- up process, and can also be found in the ‘Things you should know’ section of the Smart Savings webpage.

The CommBank app is free to download however your mobile network provider charges you for accessing data on your phone. Find out about the minimum operating system requirements on the CommBank app page. App terms and conditions are available on the app. NetBank access with NetCode SMS is required.

As this advice has been prepared without considering your financial situation, needs or objectives, you should, before acting on the advice, consider its appropriateness to your circumstances.

Terms and conditions for the accounts mentioned should be considered before making any decision. Fees and charges may apply. Applications for credit are subject to credit approval.