Help & support

Your spending decisions, no matter how small, all add up.

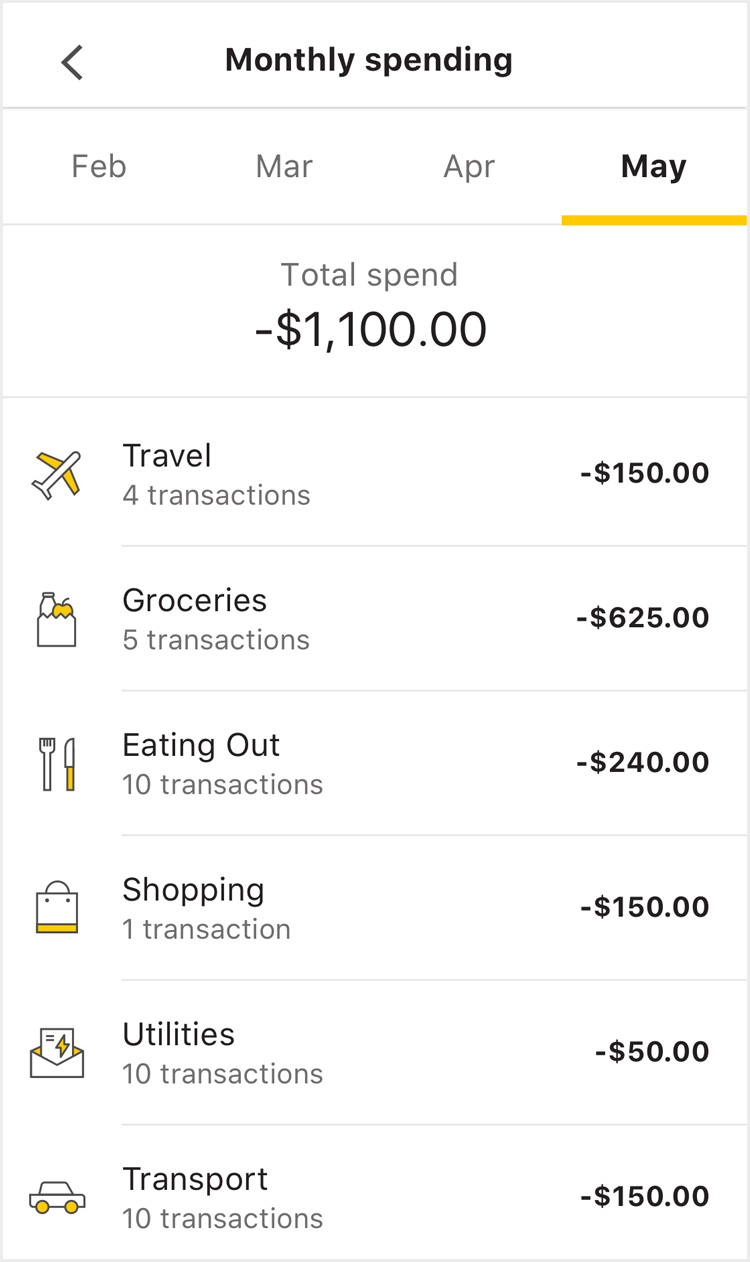

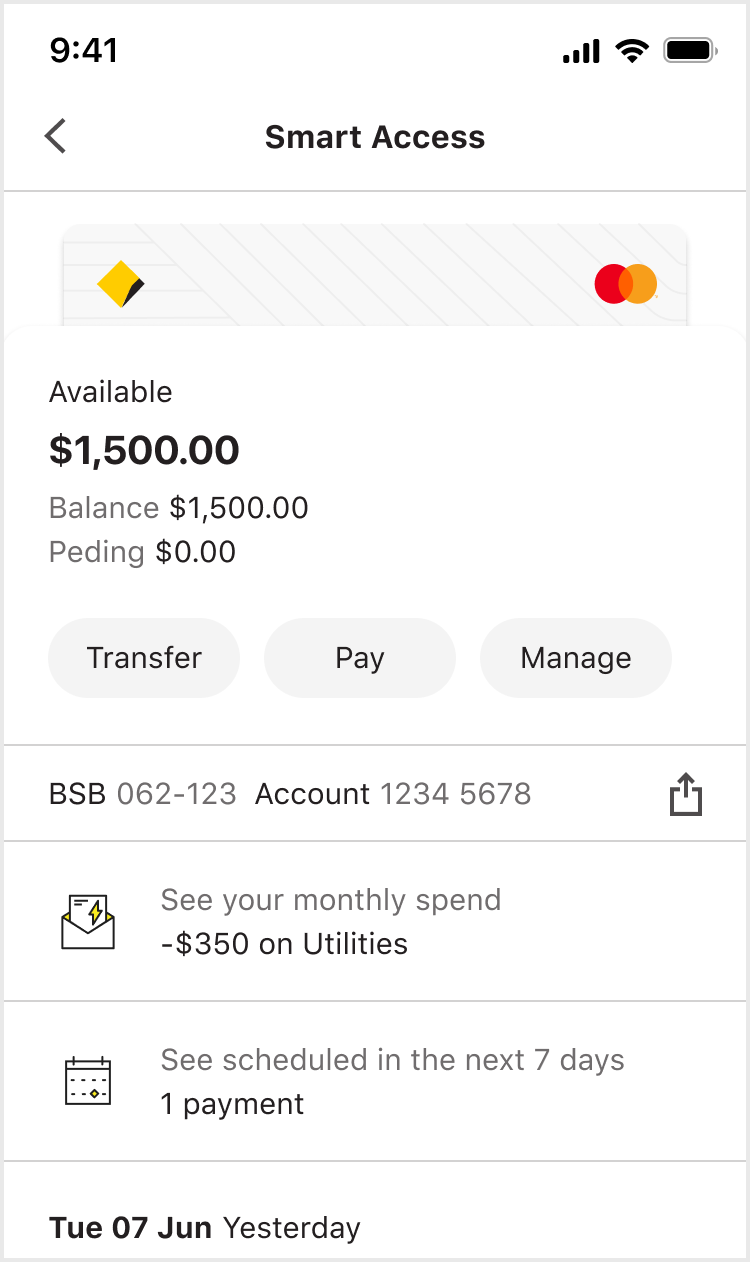

Spend Tracker categorises every debit and credit card transaction, making it easier to see the impact your spending decisions have on your everyday finances.

Knowing exactly what, where and how much you’re spending each month helps you set a budget and keep a closer eye on certain categories, so you don’t stray off track.

Spending Insights, together with Spend Tracker, gives you info to help you make better decisions about your finances, setting you up for future success.

Knowing exactly what you’re spending (and if you’re overspending) can help you get into the habit of building up, rather than dipping into, your savings.

Turn Transaction Notifications on to see, check and track your debit and credit card spending.

Trying to stick to a budget? Use Category budgets to set up simple budgets to make it easier to keep on top of your spending in categories like shopping, entertainment and eating out. Explore Category budgets

Want a snapshot of where your money’s going each month? Cash Flow View shows your income, spending, savings and investments across your CommBank accounts, and how you’re trending month-to-month. Explore Cash Flow View

The CommBank app is free to download however your mobile network provider charges you for accessing data on your phone. Find out about the minimum operating system requirements on the CommBank app page. Terms and conditions are available on the app. NetBank access with NetCode SMS is required.

1 Lock, Block and Limit enables credit card customers to lock certain transaction types and unlock them only when needed. Excludes transaction flagged as recurring (e.g. direct debits), and transactions not sent to us for authorisation, or made via Tap & Pay set up on an Android device. Other conditions apply. Commonwealth Bank of Australia ABN 48 123 123 124.