Help & support

Using the most up-to-date information from Cotality, Australia’s leading property data, information, analytics and service provider, our Property and Suburb Reports provide a comprehensive snapshot of a property and its neighbourhood.

Get the report

Following an appointment with one of our Home Lending Specialists, access an unlimited number of reports and get all the insights to the property you may be interested in buying or selling, as well as compare it against similar properties on the market.

Buy a home

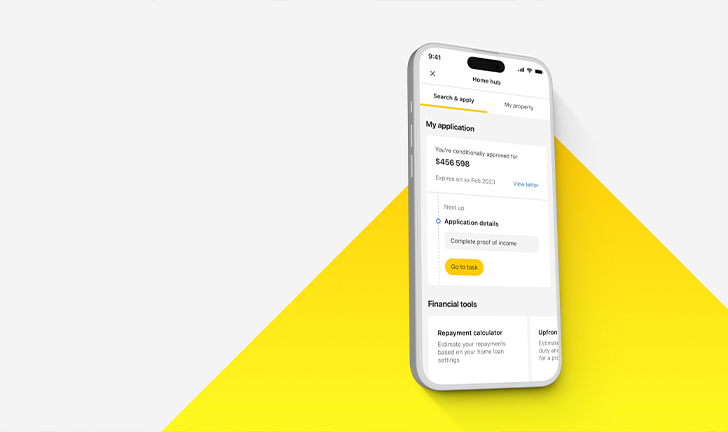

Get access to all the property reports, tools and guidance you need in one place in Buy a home within the CommBank app.

Know your borrowing power

Get the confidence to act quickly when the right property comes along. Calculate your income and expenses to estimate how much you may be able to borrow for a home loan. Check conditional pre-approval.

Find out what the property is worth based on recent comparable sales.

Our reports provide in-depth information on properties for sale in the neighbourhood, including listing dates, agents and lot plan details.

Get median sale prices, value of sales, rental and demographic profiles.

Interested in an investment property? See comparative rental properties including weekly rental prices, rental yield and capital growth.

Our lenders can perform a radius search for you that targets a particular property as a starting point and look for comparable properties in the surrounding area.

Want to be close to a certain school, your parent’s home, or workplace? Our lenders can build your own 'territories' using an interactive map that will return all the homes in this area that meet your criteria.

CommBank has partnered with Home-in, your personal home buying concierge, simplifying complex processes and helping you in every step of your home buying journey.

Get help from Ceba in the CommBank app or connect with a specialist who can message you back. You’ll need CommBank app notifications turned on so you know when you’ve received a reply.

Was the information on this page useful?

Book instantly to speak to a Home Loan Specialist at a time that suits you.

Redraw, change your repayments or loan type to better meet your needs and more.

Fast-track your call, see expected wait times and connect with a specialist in the CommBank app.

Get instant help from our virtual assistant or chat to a specialist.

^ Conditional pre-approval provides an estimate of the amount you can borrow based on the information you provide. The loan attributes, as well as interest rate changes, may result in changes to the amount you can borrow. The amount you can borrow is also subject to verification of your financial position, satisfactory security and to the Bank’s normal credit approval. It shouldn’t be considered an approval for a loan or a loan offer. Full terms and conditions (including fees and charges payable) will be included in the Bank’s offer documents, if an offer is made.