Help & support

Manage your finances securely online.

Get an overview of your finances and explore all the day-to-day details of your money.

Ideal for speedy tasks and those that take more time.

Making your day-to-day simple, quick and secure. You can pay someone, transfer money, manage your cards and bills, all on the go.

Be aware of your spending patterns and stay in control of your money with the CommBank app.

Wherever you are, whatever you are doing, you can now use your compatible phone or wearable3 to make secure, cashless payments.

And you can check your account balance on the go using your smartwatch.

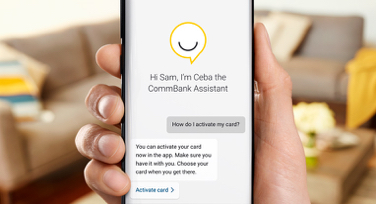

Ceba (see-bah) is our sophisticated chatbot trained to give you in-the-moment, digital support. Not to be confused with our live chat, where you have an online conversation with one of our team.

Ceba can answer your questions, show you how to do simple banking tasks or connect you with a specialist.

We want to make your move to Australia as easy as possible.

We have multilingual branch staff and we can help with all of your new to country needs. You can even collect your Debit Mastercard in-branch the day you arrive.4

You should visit your nominated specialist migrant branch once you arrive, to show us your ID, so we can activate your account.

View a list of specialist migrant branches

Any one of our Australia-wide branches can help you with your banking needs.

Get assistance with the day-to-day tasks, deal with those more complex matters and speak to our dedicated lenders and financial advisors about your personal circumstances.

Our international banking team can help you set up your banking before you arrive in Australia.

The team are available between 8am to 6pm (Sydney/Melbourne time) and can assist in a range of different languages, over the phone or on email.

You can also contact us for general enquiries, between 6am and 10pm (Sydney/Melbourne time).

Make use of the largest branch and ATM network in Australia. Most ATMs support multiple languages, including Arabic, Chinese, Vietnamese, Tagalog, Korean and Greek.

Do more than just withdraw cash - check account balances, transfer money between linked accounts, print a list of recent transactions, and even deposit notes, coins and cheques in real-time, at selected ATMs.

We’re delivering greater access to banking with Bank@Post, available at participating Post Offices.

You can open an everyday account in about 5 minutes.

1 The full version of NetBank is only available once you have had your ID checked in branch.

2 The CommBank app is only available once you have had your ID checked in branch.

The CommBank app is free to download however your mobile network provider charges you for accessing data on your phone. Find out about the minimum operating system requirements on the CommBank app page. Full terms and conditions are available on the app. NetBank access with NetCode SMS is required.

3 Google Pay is currently available for Android running 5.0 (Lollipop) or higher with a Near Field Communication (NFC) antenna and Host Card Emulation (HCE) support. Full terms and conditions available on the Google Pay app.

Samsung Pay is available on Samsung Galaxy S6 and above, Note5, Note8, A5, A7, J5 Pro and J7 Pro phones and Samsung Gear S2 and above and Sport wearables. Full terms and conditions available on the Samsung Pay app.

Check compatible devices on apple.com

Apple, the Apple logo, Apple Pay, Apple Watch, Face ID, iPad, iPhone, Safari, and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries.

4 To ensure that your card is ready and waiting for you at your chosen branch, you must have opened your account online more than 7 days before arriving in Australia. If you applied for your account after arriving in Australia, your Debit Mastercard will be mailed out to your Australian address.

Students cannot receive a Debit Mastercard in branch - a card is mailed out to the applicants address once ID has been verified in branch.

The target market for this product will be found within the product’s Target Market Determination, available here.

The advice on this website has been prepared without considering your objectives, financial situation or needs. Because of that, you should, before acting on the advice, consider its appropriateness to your circumstances. Please view our Financial Services Guide (PDF 68KB). Full terms and conditions for the transaction and savings accounts (PDF 660KB) mentioned and Electronic Banking are available here or from any branch of the Commonwealth Bank.