Help & support

Are you a business owner? Learn how you can quickly, easily and securely receive payments from customers with PayID. Explore PayID for small business.

Transfer money to friends and family using their PayID as quickly and easily as you transfer money between your CommBank accounts.

First time payments to a new payee may be held for up to 24 hours as a security measure.

Transfer money to friends and family using their PayID as quickly and easily as you transfer money between your CommBank accounts.

First time payments to a new payee may be held for up to 24 hours as a security measure.

To receive payments you’ll need to register your mobile number or email address as a PayID using the CommBank app or NetBank. It only takes a couple of minutes.

Friends and family will then be able to pay you through their own bank’s mobile or internet banking using your PayID.

To send payments to someone else, they just need to provide you with their PayID.

This may be their mobile number however other PayID types may include email, ABN, ACN and landline phone number, depending on their bank.

Joint personal account holders can link their own mobile number as a PayID to an eligible joint account.

You can register your Australian mobile phone number2 or your email address as a PayID in the CommBank app or NetBank.

Are you a business owner? You can register your ABN/ACN as a PayID to receive payments to your eligible CommBank business transaction accounts. Tell me more

A PayID can only be registered with a single bank, to one account, but an account may have multiple unique PayIDs. An alternative PayID e.g. email address or ABN, can be registered with another financial institution, or to another account.

To register in NetBank:

1. Log onto NetBank select ‘Settings’ from the menu

2. Under Payment Settings select ‘PayID’

3. Follow the prompts

You’ll be asked to confirm your new PayID details and verify your mobile number or email address by entering the NetCode we’ll send you. Once completed you’ll receive an email confirming that your registration has been successful.

To register in the CommBank app:

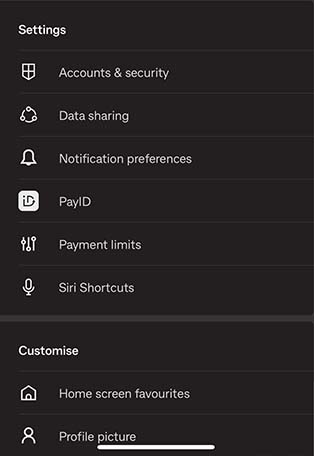

1. Log on to the app and select your 'Profile', then PayID' from the settings options

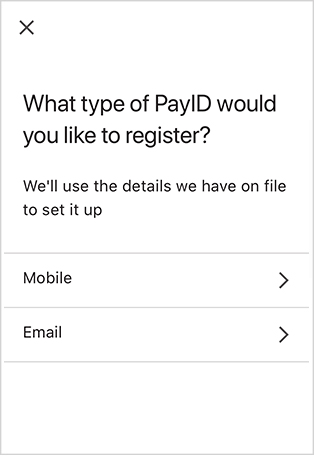

2. Choose which type of PayID you’d like to register. Then follow the prompts.

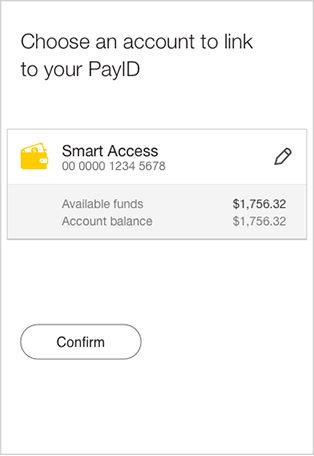

3. Choose an account to link to your PayID

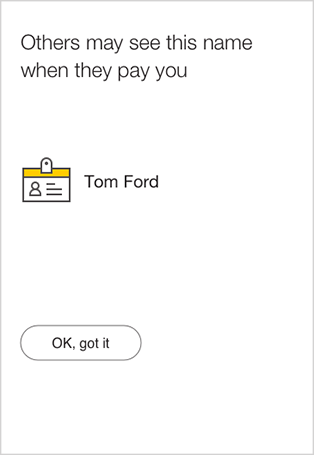

4. Confirm the name others will see

You’ll be asked to confirm your new PayID details and verify your mobile number or email address by entering the NetCode we’ll send you. Once completed you’ll receive an email confirming that your registration has been successful.

PayID is a key feature of the New Payments Platform infrastructure designed to enable fast, safe payments between participating financial institutions. We’ve been working with the other Australian banks to ensure that payments are just as secure as the payments you make today. In addition, CommBank customers benefit from a number of security features including:

You'll only be able to register a PayID for a CommBank account by first logging into the CommBank app or NetBank.

We will never send you emails asking you to confirm, update or disclose personal or banking information. If you receive an email that looks like it’s from us that you believe may be a hoax, please forward it as an attachment to [email protected]

We won’t disclose your mobile number or email address. The PayID name you choose may be displayed to someone when they make a payment to your PayID.

Get instant help from Ceba in the CommBank app or connect with a specialist who can message you back. You’ll need CommBank app notifications turned on so you know when you’ve received a reply.

Ceba can help you lock your card or securely connect you to a specialist in the CommBank app.

Fast-track your call, see expected wait times and connect with a specialist in the CommBank app.

Send us a copy or screenshot if you receive a hoax email or SMS.

There are four types of PayID: phone number, email address, ABN/ACN and organisational ID. We offer mobile number and email address as PayID via NetBank and the CommBank app. Our business customers can register an ABN/ACN PayID by contacting us.

1 For security reasons, a hold may apply on first time payments. The delay allows fraud security checks to take place and gives you time to alert us to unauthorised or suspicious activity on your account. Subsequent payments should be received in under a minute.

2 To prevent fraud we can only allow you to register the primary mobile number already linked to your CommBank customer profile. If you’d like to use a different mobile number or need to update your details please call 13 2221.

3 Protecting you is our priority and for security reasons, we may block certain payments.

® Registered to BPAY Pty Ltd. ABN 69 079 137 518

PayID® is a registered trademark of NPP Australia Limited.

View our full terms and conditions here: www.commbank.com.au/digital-banking/pay-id/terms-and-conditions.