Help & support

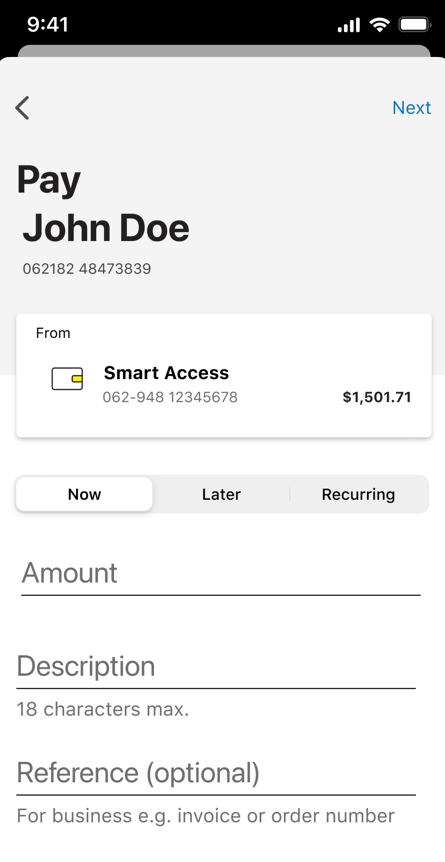

To transfer money to someone overseas, you’ll need their full name, home address, account number or International Bank Account Number (IBAN) and the SWIFT or Bank Identification Code (BIC) of their bank

Get instant help from Ceba in the CommBank app or connect with a specialist who can message you back. You’ll need CommBank app notifications turned on so you know when you’ve received a reply.

1 An unlinked account is any account which doesn’t appear in your NetBank profile, such as CommBank accounts not in your name (like your friends' or business acquaintances' accounts) or accounts held with other financial institutions. A linked account appears in NetBank with details like balance and transaction information.

The CommBank app is free to download however your mobile network provider charges you for accessing data on your phone. Find out about the minimum operating system requirements on the CommBank app page. Terms and conditions are available on the app. NetBank access with NetCode SMS is required. Full terms and conditions available on the CommBank app.