Help & support

Use your income and expenses to estimate how much you may be able to borrow for a home loan.

Estimate the other costs of buying a property, including government costs, stamp duty, and fees.

You could potentially save by refinancing your current home loan with us.

Want to know more about a property or an area you’re considering buying or selling in? Your complimentary Property Report is customised to your needs, with the latest information on new listings, auctions and recent sales.

Find your perfect property sooner with market estimates and affordability snapshots.

Compare home loan options and adjust variables like interest rates and loan term.

Work out your budget based on household and lifestyle expenses, to get an idea of how much you may be able to afford in repayments.

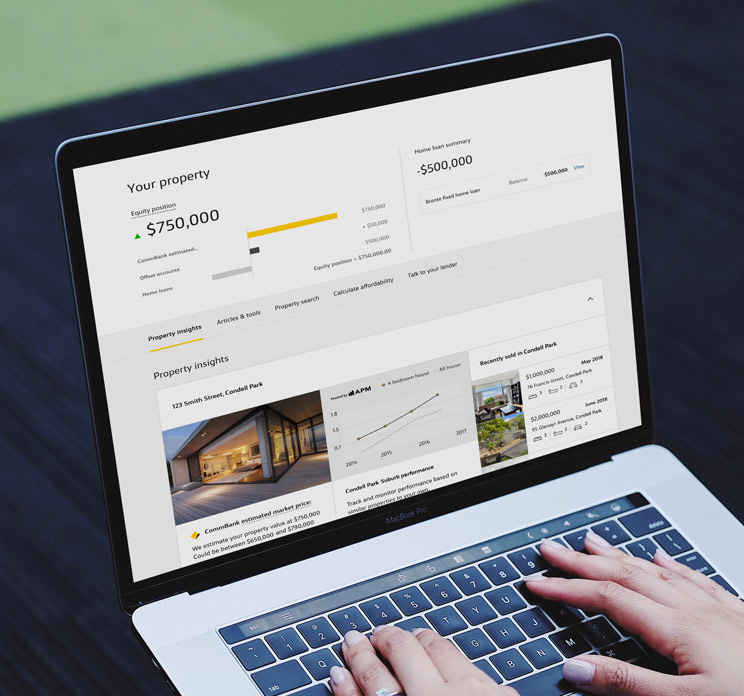

Get access to all the property tools and guidance you need in one place in Buy a home within the CommBank app.

Log on to NetBank to view your estimated payout figure, including all fees and interest, for your chosen settlement date.

Home-in’s experienced team and secure, award-winning app1 will help guide you through the conveyancing process. Built by CommBank and trusted by thousands of Australian home buyers, receive real-time status updates, six-hour contract reviews2, and one of the industry’s best on-day settlement rates3.

Expert guidance, handy tips and useful information – because everyone’s home buying needs are different.

A step-by-step guide to help you refinance, whether it’s for an existing CommBank home loan or to switch from another financial institution.

A comprehensive guide to help you understand the process of building a new home, so you can be in control.

Get help from Ceba in the CommBank app or connect with a specialist who can message you back. You’ll need CommBank app notifications turned on so you know when you’ve received a reply.

Was the information on this page useful?

Book instantly to speak to a Home Loan Specialist at a time that suits you.

Redraw, change your repayments or loan type to better meet your needs and more.

Fast-track your call, see expected wait times and connect with a specialist in the CommBank app.

Get instant help from our virtual assistant or chat to a specialist.

1 We Money - Property Innovation of the Year Award (2024), Customer Service Excellence Award - Customer Service Organization of the Year: Small (2023), Finder Innovation Awards - Best Online Customer Service Innovation (2023).

2 Contracts are reviewed within six business hours 95% of the time (October 2023). To ensure contracts are reviewed within six business hours, customers must upload the entire contract within the Home-in app.

3 Home-in has one of the highest on-time settlement rates in the industry with 95% of Home-in customers settling on time in 2023.

* This offer is valid from 6 May 2025. To secure the offer you will need to engage the services of a Home-in partner law firm via the Home-in app on or after this date. If you engaged the services of a Home-in partner law firm via the Home-in app before this date, you are not eligible for this offer. This offer cannot be combined with other Home-in offers.

This offer is only available to CommBank customers who meet the following criteria:

(a) have an eligible CommBank transaction account: Smart Access, Complete Access, Everyday Offset, Pensioner Security (excluding Pensioner Security Passbook accounts) or Private Bank Account; and

(b) fund an eligible residential property purchase with a CommBank home loan; and

(c) settle this property purchase using the in-app legal services provided through Home-in.

This offer only applies to buy-side conveyancing services for residential property purchases in Australia. Home-in does not offer conveyancing services for the purchase of off-the-plan, rural/agricultural, retail or commercial properties, or properties with a purchase price in excess of $5,000,000. Additional fees apply to conveyancing services in respect of complex titles (such as old system, leasehold and company titles), which are excluded from this offer.

This offer is only available through CommBank’s proprietary channels, it is not available to customers that originate through Bankwest, Unloan or a broker channel.

If you settle on a property without meeting the eligibility criteria, this offer will not apply and you will be required to pay the standard list price for your conveyancing services. If you do not ultimately settle on a property purchase with Home-in within 6 months of your first contract review, any disbursements, contract review fees and ancillary service fees incurred will become payable to Home-in at the standard list price.

The $699 (including GST) offer includes the following conveyancing services: one standard contract review, reasonable negotiation with the vendor’s solicitor, preparation of documents and figures required for settlement and electronic or paper settlement for your property.

Disbursements are additional and charged at cost. For some property purchases, you may require or request additional services for which we charge a professional fee, such as expedited settlement or usage of a trust account.

Find out more about Home-in's pricing by visiting home-in.com.au/pricing. Home-in reserves the right to terminate the offer and change the pricing at any time.

Home-in is a brand of CBA New Digital Businesses Pty Ltd ABN 38 633 072 830 trading as Home-in Digital. CBA New Digital Businesses Pty Ltd is a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124. CBA New Digital Businesses Pty Ltd is not an Authorised Deposit-taking Institution for the purposes of the Banking Act 1959 (Cth) and its obligations do not represent deposits or other liabilities of Commonwealth Bank of Australia.

Applications for finance are subject to the Bank's normal credit approval. Full terms and conditions will be included in the Bank's loan offer. Fees and charges are payable.

Our calculators and tools provide estimates for your general information only and are based on the accuracy of information input. The estimates are not a quote or a loan offer.

To be eligible for Wealth Package, you must have a current eligible home loan or line of credit with an initial package lending balance of at least $150,000 when you apply for Wealth Package. The package can be established in the name of one or two individual’s name/s, or in the name of a corporate entity. It cannot be established in the name of a business or family investment trust. Trust loans can however be linked to the trustee package (personal or company package) where the trustee is an applicant (i.e. the borrower) on the loan. For example, a loan held in the name of “John Smith ITF The Smith Family Trust” can have a package established in the name of John Smith as the trustee.

Apple, the Apple logo and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc.