Help & support

You may be able to access a range of tailored support options if you or your business are impacted by a natural disaster or other unforeseen event.

To discuss your individual circumstances please take a look at our support options and contact us as soon as you are able. You can message us in the CommBank app, call Emergency Assist on 1800 314 695 or visit us in branch where it is safe to do so.

If English isn’t your first language, the government’s free Translating and Interpreter Service can help you to communicate with us. This service is available in over 150 languages.

Find out how to access this service by visiting our Accessibility page.

In addition to contacting us, you may also find these external support services helpful if you’re experiencing financial hardship.

We're here to help support you and your family

The Australian Government has a range of payments, allowances and support for people directly affected by a natural disaster event. See what natural disaster support is available from Services Australia.

State and territory specific grants and rebates can be found below. New grants and rebates will be linked here as they become available:

Some of our branches, ATMs and local banking services may be unavailable during extreme weather. Use our branch locator tool to find your closest branch, or visit our service updates page for the most up-to-date branch information.

There are a number of ways you can do your banking – including online, in person or over the phone. The CommBank app provides you with useful tools and features to help keep you safe, manage your banking and connect with support.

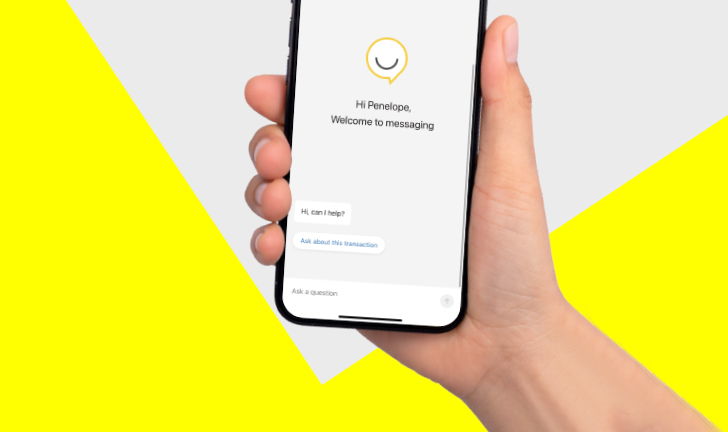

If you need support in an emergency, chat to our virtual assistant anytime, or connect to a specialist who can message you back. You'll need notifications for the CommBank app turned on so you know when you've received a reply.

Bushfire, storm and flood are three of the standard inclusions^^ under Comprehensive Car insurance and Home and/or Contents Insurance policies for customers who have taken out Home Insurance provided by Hollard, distributed by CommBank.

If your car or home have been damaged by the weather events across Australia, you can lodge a claim online in the My Claims Portal (accessible through NetBank or the CommBank app) or by calling 13 1361. It’s ok if you don’t know your policy number – all you need to provide is your name and address. On-the-ground support may be available in affected areas - check live locations and hours.

If your home is at risk of further damage or you are unable to live in it, please call the Emergency Claims Assistance line anytime on 13 1361.

During this time, customers should also remain vigilant and be extra cautious of unexpected calls or messages claiming to be from well-known organisations including banks, telecommunications companies and government agencies.

How customers can better protect themselves from scams:

Remember, we’ll never send you an SMS or email that:

Always type commbank.com.au into a browser or use the CommBank app to securely access your banking.

If you think you might have been impacted by a scam, you should report it right away.

Cyclones, bushfires, floods, drought, and storms can cause personal and financial hardship for people and communities. We’re here to support our customers impacted by natural disasters, however we can.

As the advice on this page has been prepared without considering your objectives, financial situation or needs, you should, before acting on the advice, consider its appropriateness to your circumstances. Terms and conditions are available here and should be considered before making any decision. Fees and charges may apply.

* Businesses eligible to apply for a three month loan repayment deferral include any CommBank business customer who holds a Variable BetterBusiness Loan or Variable SuperGear Loan as of 23 February 2022 within impacted flood postcodes with less than $10,000,000 of total liabilities with CommBank. Deferrals are only applicable on Principal and Interest repayment arrangements. Government Scheme loans may be eligible for repayment deferrals, however, customers will need to contact the Business Financial Assistance Team on 13 26 07 or your dedicated relationship manager for assistance. Fixed rate loans, and loans in arrears are excluded from repayment deferrals. Loan repayment deferrals are offered at the final discretion of the bank.

Loan repayment deferrals are offered at the final discretion of the bank. These products are only available to approved business customers and for business purposes only. Applications for finance are subject to the Bank’s eligibility and suitability criteria and normal credit approval processes. Applications for finance are subject to the Bank’s eligibility and suitability criteria and normal credit approval processes. View our current Terms and Conditions for Business Finance and SuperGear and consider them before making any decision about these products. For current interest rates, visit Business banking rates and fees.

#Temporary accommodation is available with Contents Cover if you are the owner occupier of a Strata titled property. Cover limits apply, read the Home Insurance PDS.

Home Insurance, Landlord Insurance and Car Insurance are provided and issued by Hollard Insurance Partners Limited ABN 96 067 524 216, AFSL 235030 (Hollard) and distributed by the Commonwealth Bank of Australia ABN 48 123 123 124, AFSL 234945 (CBA).

^ Eligibility is subject to the Bank’s case-by-case assessment and approval. Please view our Merchant Agreement and Financial Services Guide and consider them before making any decision about these products.

^^ Conditions, limitations and exclusions apply. Please read our Product Disclosure Statements (PDS) for full terms and conditions.

Cash and banking options

1 Transaction limits and fees may apply.

2 For primary linked accounts.

3 The CommBank app is free to download; however, your mobile network provider charges you for accessing data on your phone. NetBank access with NetCode SMS required. Find out about the minimum operating requirements on the CommBank app page.